Calculated Risk has a great post on some of the components of GDP and their relation to recessions.

His first chart looks at Private Fixed Investment. You can click on it for a larger image. He notes that “Private fixed investment has fallen 13 times since 1948 (14 including the current slump), with only 10 recessions.” He comments that in the dips in 1951, 1967, and the minor slump in 1986, private investment fell, but the economy didn't slide into recession. However, each time was accompanied with a surge in defense spending with the Korean war, the Vietnam war, and the general defense build-up with the Cold War.

He notes that “Private fixed investment has fallen 13 times since 1948 (14 including the current slump), with only 10 recessions.” He comments that in the dips in 1951, 1967, and the minor slump in 1986, private investment fell, but the economy didn't slide into recession. However, each time was accompanied with a surge in defense spending with the Korean war, the Vietnam war, and the general defense build-up with the Cold War.

Here is a chart with Defense Spending. The Defense Spending in the first quarter of 1951 through the second quarter of 1952 was off the chart (65% in the first quarter, 98%, 118%, 111%, 75%, and 47% in the 2nd quarter of 1952).

The Defense Spending in the first quarter of 1951 through the second quarter of 1952 was off the chart (65% in the first quarter, 98%, 118%, 111%, 75%, and 47% in the 2nd quarter of 1952).

Calculated Risk points out that “the year-over-year change in private fixed investment appeared to have bottomed in early 2007, suggesting the economy might have avoided a recession”. Currently our Defense spending is up helping to cushion the drop in fixed investment. But Defense spending is not up at the high levels it was at during the previous wars.

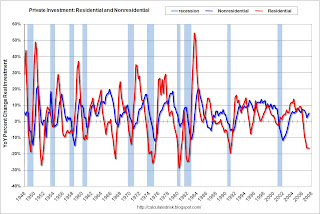

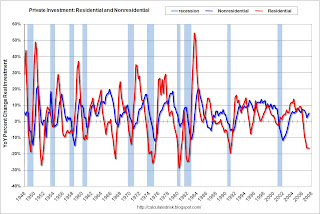

Calculated Risk created a second graph separating private fixed investment into residential and nonresidential components. He illustrates that in general “residential investment leads nonresidential investment.” If residential investment continues to fall, it suggests that nonresidential fixed investment would also fall.

He illustrates that in general “residential investment leads nonresidential investment.” If residential investment continues to fall, it suggests that nonresidential fixed investment would also fall.

Calculated Risk also has good charts on residential investment compared to equipment and software investment and also compared to structures. Both those components of GDP tend to lag residential investment.

Edward Leamer, a Professor at UCLA, presented “Housing is the Business Cycle” at the Housing, Housing Finance, and Monetary Policy Symposium sponsored by the Fed in August 2007. In his presentation, he noted some of the same dynamics.

Sphere: Related Content

His first chart looks at Private Fixed Investment. You can click on it for a larger image.

He notes that “Private fixed investment has fallen 13 times since 1948 (14 including the current slump), with only 10 recessions.” He comments that in the dips in 1951, 1967, and the minor slump in 1986, private investment fell, but the economy didn't slide into recession. However, each time was accompanied with a surge in defense spending with the Korean war, the Vietnam war, and the general defense build-up with the Cold War.

He notes that “Private fixed investment has fallen 13 times since 1948 (14 including the current slump), with only 10 recessions.” He comments that in the dips in 1951, 1967, and the minor slump in 1986, private investment fell, but the economy didn't slide into recession. However, each time was accompanied with a surge in defense spending with the Korean war, the Vietnam war, and the general defense build-up with the Cold War.Here is a chart with Defense Spending.

The Defense Spending in the first quarter of 1951 through the second quarter of 1952 was off the chart (65% in the first quarter, 98%, 118%, 111%, 75%, and 47% in the 2nd quarter of 1952).

The Defense Spending in the first quarter of 1951 through the second quarter of 1952 was off the chart (65% in the first quarter, 98%, 118%, 111%, 75%, and 47% in the 2nd quarter of 1952).Calculated Risk points out that “the year-over-year change in private fixed investment appeared to have bottomed in early 2007, suggesting the economy might have avoided a recession”. Currently our Defense spending is up helping to cushion the drop in fixed investment. But Defense spending is not up at the high levels it was at during the previous wars.

Calculated Risk created a second graph separating private fixed investment into residential and nonresidential components.

He illustrates that in general “residential investment leads nonresidential investment.” If residential investment continues to fall, it suggests that nonresidential fixed investment would also fall.

He illustrates that in general “residential investment leads nonresidential investment.” If residential investment continues to fall, it suggests that nonresidential fixed investment would also fall.Calculated Risk also has good charts on residential investment compared to equipment and software investment and also compared to structures. Both those components of GDP tend to lag residential investment.

Edward Leamer, a Professor at UCLA, presented “Housing is the Business Cycle” at the Housing, Housing Finance, and Monetary Policy Symposium sponsored by the Fed in August 2007. In his presentation, he noted some of the same dynamics.

“Residential investment consistently and substantially contributes to weakness

before the recessions, but business investment in equipment and software does

not. And the recovery for residences begins earlier and is complete earlier than

the recovery for equipment and software.”

Residential investment “contributes most to weakness before recessions. In 6 ofConsumer durables, consumer services, and then consumer non-durables were the next significant contributers.

the 10 recessions, residential investment was the greatest contributor to

weakness prior to the recession. Only twice of 10 did residential investment not

contribute significantly to weakness prior to the recession: the 1953 and 2001

oddballs. “

"Equipment and software ranks as the number one source of weakness during the

recessions compared to a rank of six prior to the recessions. In terms of their

impacts during recessions, after business spending on equipment and software

came consumer spending on durable and nondurables."

Leamer said that after residential investment, the next best predictor of recessions is consumer durables and consumer services. Here are graphs of each.

Neither consumer durables or consumer services dipped in the 3rd quarter of 2007. The 4th quarter 2007 GDP figures are due to be released on January 30, 2008.

No comments:

Post a Comment