Monday, November 23, 2009

Thursday, November 19, 2009

Thursday, October 29, 2009

Thursday, September 10, 2009

Meredith Whitney's outlook

Meredith Whitney moved the markets last July when she made a bullish call on Goldman Sachs' earnings. Here she is with a bearish outlook. She is calling for a further decline in housing prices of 25%.

Sphere: Related ContentTuesday, August 25, 2009

S&P Case Shiller Index posts strong gains

The S&P Case Shiller Index posted strong gains. Month over month, the Composite-10 index increased by 1.9%. The index is still down 15.13% year over year. 17 of the 20 markets in the Composite-20 index posted positive month over month gains. The data for the index is a compiled using a three month average. Since last month was positive and the trend is moving up strongly, next month should also come in with a strong gain.  The month over month gains are the highest since the market peaked in 2005.

The month over month gains are the highest since the market peaked in 2005.

I have removed the CME Housing Futures data from the chart because they have become so thinly traded.

Thursday, August 20, 2009

Mortgage Delinquencies continue rising higher

The Mortgage Bankers Association released their National Delinquency Survey for the Second Quarter of 2009. The total residential mortgages that are at least 30 days delinquent rose to 9.24%. When including loans that are in the foreclosure process the figure rises to a startling 13.16%.

The percentage of loans that are in the foreclosure process rose to 4.30% in the second quarter up from 3.85% in the first quarter.

at

8/20/2009 05:32:00 PM

10

comments

![]()

Labels: Credit Crisis, Delinquencies

Monday, July 13, 2009

Meredith Whitney is bullish on banks

Meredith Whitney, the so-called most powerful woman on Wall Street, moved the markets today with a bullish short term call on the banks. She was particularly bullish on Goldman Sachs. Her earnings estimate for Goldman Sachs, which reports tomorrow, is $4.65 compared to consensus estimates of $3.48. She predicts they will earn $20 for 2009 and more than $22 for 2010.

Goldman Sachs had their highest earnings in 2007 at $24.73. 2006 was at $19.71. In a year where Goldman Sachs is deleveraging, if they can pull off these types of earnings, it will be remarkable.

Naked Capitalism has two videos of Meredith Whitney making these calls.

at

7/13/2009 05:13:00 PM

4

comments

![]()

Labels: Credit Crisis, Stocks

Friday, July 10, 2009

An overview of the housing crisis

Zero Hedge has a presentation from T2 Partners on where we are at in the housing crisis. It is packed full of great charts.

Here are a few of my favorites:

Sphere: Related Content

Sphere: Related Content

Tuesday, June 30, 2009

Case-Shiller index shows the decline in housing prices is slowing

The S&P Case-Shiller home price index for April 2009 was released today by Standard and Poors. The composite-10 declined 0.67% in April compared to March 2009 (last month it declined by 2.10%) and declined by 18.01% from a year ago (compared to 18.68% last month).

The composite-10 is now down 33.56% from its peak. The Composite-10 has now declined at a slower pace year over year for three months in a row after declining at a faster pace each month for 25 months in a row. The home price index is not seasonally adjusted. In the last 20 years, home prices have averaged appreciation of 5.29% a year. March through August are typically the strongest months for appreciation and home prices have on average appreciated by 4.40% during that 6 month period. September through February are the weakest months; home prices have on average appreciated by only 0.89% during that 6 month period. In the next month or two, the index could post a positive month over month gain. However, I expect it to fall again as we head into the winter months.

The CME futures market is pricing in a further drop of -10.20% by next March for the composite-10.

You can click on the images for a larger view.

Sphere: Related ContentTuesday, June 23, 2009

Existing Home Sales and Median Prices Rise Slightly

The National Association of Realtors released the existing home sales figures for May 2009 today. Sales increased to a seasonally adjusted annual rate of 4.770 million units in March up from 4.660 million units in April and down from 4.950 million units in May 2008.

The median sales price was $176,000 for May up from $166,600 in April (up 3.8%) but down from $207,900 in May 2008 (down 16.8%). Months supply was 9.6 in May, down from 10.1 in April. According to the NAR, distressed properties accounted for 33% of all transactions in May down from 45% in April.

Sphere: Related Content

Sphere: Related Content

Thursday, June 11, 2009

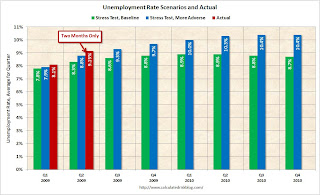

An alternate "more adverse" scenario

So far, the unemployment rate has been higher than the "more adverse" scenario used in the stress test. Calculated Risk has an updated chart using just two month's of data:

The "more adverse" scenario seems to be a plausible forecast for the economy. In fact, the Unemployment rate looks like it will reach 10.3% this year which is the "more adverse" scenario for the average unemployment rate for 2010. Per the Federal Reserve, "the likelihood that the average unemployment rate in 2010 could be at least as high as in the alternative more adverse scenario is roughly 10 percent." If the "more adverse" scenario is the new baseline forecast, then I wonder how the banks would fare in a worse case scenario.

Seeking Alpha has a great spreadsheet that let's you plug in different unemployment rate forecasts and loss rate assumptions. In the Stress Test, the economists had forecast that the average unemployment rate for 2010 would be 8.8% with a 10% chance of being 1.5% higher at 10.3%. In spreadsheet to the right, I am using an unemployment rate of 11.8% as the more adverse scenario (if you change the baseline forecast to 10.3%, then it seemed logical that there would be a 10% chance that the unemployment rate would reach 11.8%).

There is a big disparity between the healthy banks and the banks that would be stressed under a more adverse scenario than the Fed used.

Sphere: Related ContentWednesday, June 10, 2009

Talking Heads

Jon Stewart had an interesting interview with Peter Schiff where he compiled different clips over the years of people laughing at Schiff's calls.

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Peter Schiff | ||||

| www.thedailyshow.com | ||||

| ||||

Here is Peter Schiff in a blast from the past:

But as David Rosenberg once said, "In order for an economic forecast to be relevant, it must be combined with a market call."

Sphere: Related Content

Tuesday, May 26, 2009

Case-Shiller Home Price Index Falls at Slower Pace

The S&P Case-Shiller home price index for March 2009 was released today by Standard and Poors. The composite-10 declined 2.06% in March compared to February 2009 (last month it declined by 2.12%) and declined by 18.65% from a year ago (compared to 18.89% last month).

The composite-10 is now down 33.09% from its peak. The Composite-10 has now declined at a slower pace year over year for two months in a row after declining at a faster pace each month for 25 months in a row.

The CME futures market is pricing in a further drop of -10.40% by next March for the composite-10.

You can click on the images for a larger view.

Sphere: Related Content

Sphere: Related Content

Friday, May 22, 2009

Sunday, May 17, 2009

Job losses at the county level

Slate.com has an amazing graphic showing the job losses month by month, county by county. Just as recently as June 2008 (as the map on the right shows), there was year over year job growth. Job losses really started accelerating in November 2008. April 2009 figures at the county level are not out yet, but we already know from the national data that the year over year job losses will be over 5.5 million.

Click here for the article and to view the map.

Sphere: Related Content

at

5/17/2009 07:34:00 PM

0

comments

![]()

Labels: employment, Unemployment

Friday, May 8, 2009

Unemployment Rate rises to 8.9%

According to "The Employment Situation" for April 2009, released today by the U.S. Department of Labor, seasonally adjusted, the unemployment rate was 8.9%, up from 8.5% in March and 5.0% a year ago. The unemployment rate is now up 3.5 percentage points in the last twelve months and is up 4.1 percentage points from its recent low of 4.4%. Nonfarm payrolls decreased by 539,000 in April down from a revised 699,000 in March. This month they revised the previous two months of March and February downward by 66,000 jobs. Last month, the total jobs lost from December 2007 to March 2009 was reported to be 5,133,000. This month, with the revisions, the total jobs lost from December 2007 to April 2009 has reached 5,738,000 jobs. The average recession since World War II has had a loss of 1,917,000 job. The biggest loss before this recession came in 1982 with 2,838,000 jobs lost. In terms of job loss, we are in the biggest recession since the Great Depression.

The U.S. Department of Labor released the Weekly Claims data for Unemployment Insurance yesterday. Initial claims were at 601,000 for the week ending May 2. This is down from the previous week's number of 635,000. The four week average of initial claims, which is not as volatile, was at 623,500. This is down from the previous week's figure of 638,250. Continued claims for unemployment insurance increased to 6,351,000 for the week ending April 25th up from the previous week's number of 6,295,000. The four week average for continued claims was also up to 6,207,000 from 6,082,000. This is the highest continued claims has ever been. The previous high was in 1982. Initial claims is faster to move up and signals increases in the unemployment rate. Continued claims take longer to go down than the initial claims once the unemployment rate is elevated. The Unemployment rate doesn't drop until continued claims start to come down.

Sphere: Related Content

Sphere: Related Content

Tuesday, April 28, 2009

Case-Shiller Home Price Index decline slows

The S&P Case-Shiller home price index for February 2009 was released today by Standard and Poors. The composite-10 declined 2.11% from January 2008 (last month it declined by 2.55%) and declined by 18.83% from a year ago (compared to 19.39% last month). The composite-10 is now down 31.64% from its peak.

The Composite-10 has now declined at a slower pace year over year for the first time in over two years. The CME futures market is pricing in a further drop of -12.30% by next February for the composite-10.

You can click on the images for a larger view.

Sphere: Related Content

Sphere: Related Content

Friday, April 24, 2009

Existing home sales decrease but median sales price is up

The National Association of Realtors released the existing home sales figures for March 2009 yesterday. Sales decreased to a seasonally adjusted annual rate of 4.570 million units in March down from 4.710 million units in February and down from 4.920 million units in March 2008.

The median sales price was $175,200 for March up from $168,200 in February (up 4.16%) but down from $200,100 in March 2008 (down 12.4%). Months supply was 9.8 in March, up from 9.7 in February. According to the NAR, distressed properties accounted for just over half of all transactions in March and are selling for 20 percent less than traditional homes.

Sphere: Related Content

Sphere: Related Content