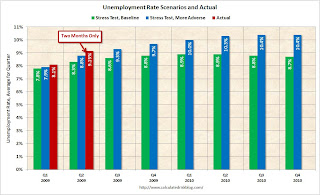

So far, the unemployment rate has been higher than the "more adverse" scenario used in the stress test. Calculated Risk has an updated chart using just two month's of data:

The "more adverse" scenario seems to be a plausible forecast for the economy. In fact, the Unemployment rate looks like it will reach 10.3% this year which is the "more adverse" scenario for the average unemployment rate for 2010. Per the Federal Reserve, "the likelihood that the average unemployment rate in 2010 could be at least as high as in the alternative more adverse scenario is roughly 10 percent." If the "more adverse" scenario is the new baseline forecast, then I wonder how the banks would fare in a worse case scenario.

Seeking Alpha has a great spreadsheet that let's you plug in different unemployment rate forecasts and loss rate assumptions. In the Stress Test, the economists had forecast that the average unemployment rate for 2010 would be 8.8% with a 10% chance of being 1.5% higher at 10.3%. In spreadsheet to the right, I am using an unemployment rate of 11.8% as the more adverse scenario (if you change the baseline forecast to 10.3%, then it seemed logical that there would be a 10% chance that the unemployment rate would reach 11.8%).

There is a big disparity between the healthy banks and the banks that would be stressed under a more adverse scenario than the Fed used.

Sphere: Related Content

No comments:

Post a Comment